Browse Exclusive Deals

Discover vetted private companies and growth-stage businesses with full disclosure on financials, valuations, and exit strategies. Each opportunity is tokenized for transparent equity ownership.

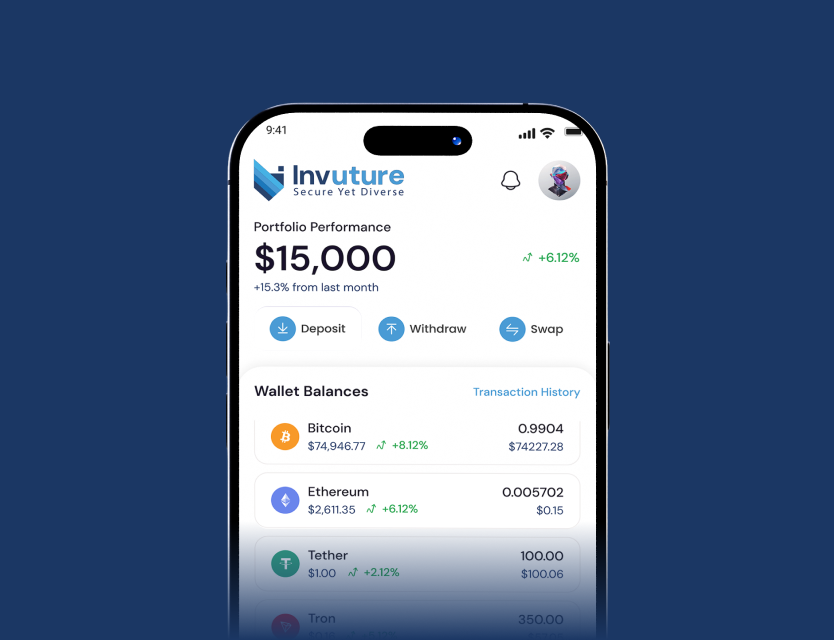

+15.3% from last month

+2 new this month

+2 new this month

Private equity historically required investor accreditation and heavy legal oversight. On Invuture, ONCHAINID verifies investor accreditation and ties that status to permissioned wallets, so only qualified participants can hold specific equity tokens. Built-in KYC/AML and transfer restrictions make sure tokens cannot be sold to unqualified or sanctioned parties, thereby preserving both regulatory compliance and valuation integrity.

Tokenization allows smaller investors to own fractional shares of private companies that were previously restricted to larger funds. By lowering minimums, Invuture enables diversified exposure to early-stage ventures and pre-IPO rounds. Fractional equity improves risk management because investors can spread capital across multiple startups instead of concentrating on a single opportunity. For entrepreneurs, fractionalized equity provides a way to raise capital efficiently.

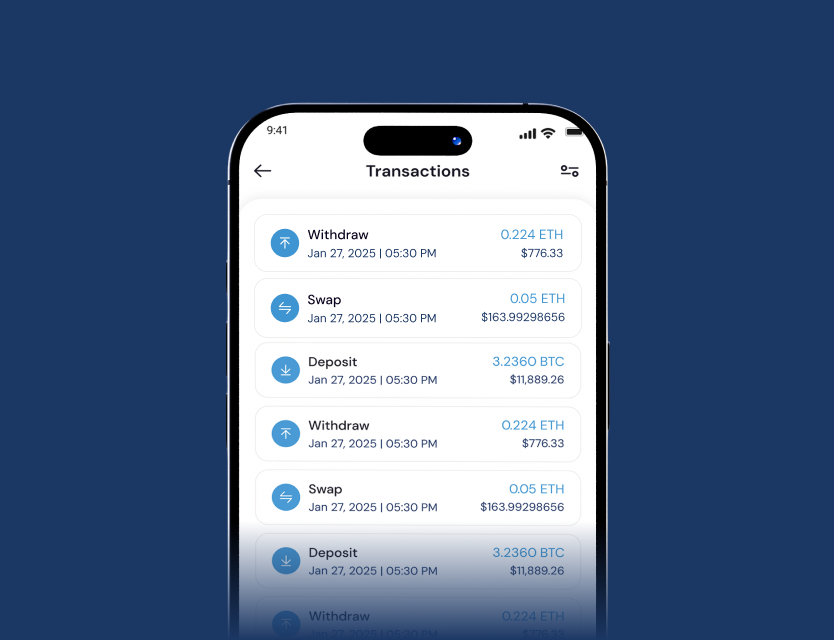

Tokenized private equity opens regulated secondary markets that let investors reprice and trade ownership without forcing a corporate exit. Trades occur within permissioned venues that enforce investor eligibility and constraints encoded in smart contracts. ONCHAINID-based permissions prevent transfers outside approved jurisdictions, preserving compliance and investor protections. Liquidity windows and lockup rules can be embedded in code to replicate the governance structures.

Discover vetted private companies and growth-stage businesses with full disclosure on financials, valuations, and exit strategies. Each opportunity is tokenized for transparent equity ownership.

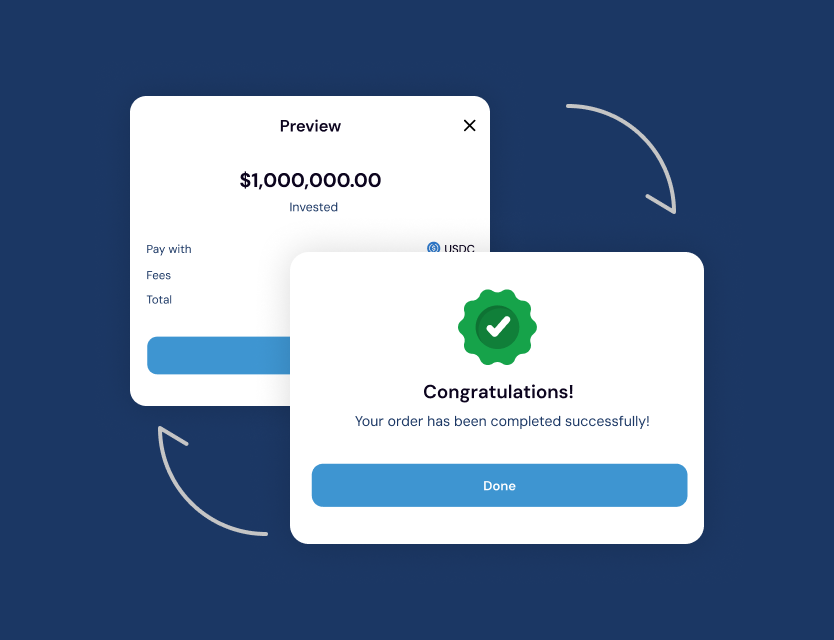

Enter high-barrier markets with as little as AED 500, owning fractional shares in private ventures typically reserved for institutional investors. Smart contracts ensure legal alignment and secure record-keeping.

Earn through dividend payouts or equity appreciation upon liquidity events. Trade your private equity tokens on the platform’s secondary market for flexible exit options.

Invuture gives you access to real estate, private equity, commodities, and luxury assets fractionalized, verified, and secured on the blockchain. Start investing today and manage it all in one seamless, secure app-driven platform.